What are Private Assets (or Alternatives)?

Private assets (or alternative investments) is a broad term for financial investments that do NOT fall into the conventional publicly traded asset classes of stocks (listed equity), bonds (listed fixed income), and cash.

Key sub-categories of private assets:

- Private Equity

- Private Credit

- Real Estate

- Infrastructure

- Hedge Funds

Main goals of allocating to alternatives:

- Enhance returns: Seek higher potential returns than public markets

- Diversify portfolios: Gain exposure to different risk/return drivers that are not correlated to public market

- Generate income: Especially for private credit and real estate

- Hedge inflation: Certain assets such as real estate and infrastructure can act as a hedge

What is Private Credit?

Private credit refers to many types of privately negotiated debts (including loans/notes) between a borrower and a non-bank lender, typically private funds, asset managers, or specialised lending institutions. Private credit enables borrowers to access capital with customised financing details, giving them more flexibility and speed of lending.

Key characteristics of private credit:

- Privately originated and held: These loans are not originated by banks and are not traded on public markets such as bonds or syndicated loans.

- Floating rates: Most private credit loans have floating interest rates (e.g. SOFR + spread), protecting lenders when interest rate rises, and their income also rises.

- Customisation and flexibility: These loans are bilaterally negotiated, allowing for tailored terms, covenants, and structures to meet the specific needs of borrowers and lenders.

- Illiquidity: They are typically held to maturity (often 5-7 years). Due to the lack of a liquid secondary market, investors are generally compensated with higher yields compared to public credit markets.

Common types of private credit:

- Direct lending: Representing the largest segment, providing senior secured loans to mid-market companies for purposes such as leveraged buyouts, acquisitions, or recapitalisations

- Mezzanine debt: Debt that sits between senior loans and equity, offering higher yields and often with an equity “kicker” (warrants)

- Distressed debt: Debt of financially troubled companies, with the potential for restructuring or liquidation recoveries

- Special situations: Loans for complex event-driven needs such as bridge loans, turnaround financing, or litigation funding

- Real asset lending: Loans backed by physical assets such as real estate, infrastructure, or aircrafts

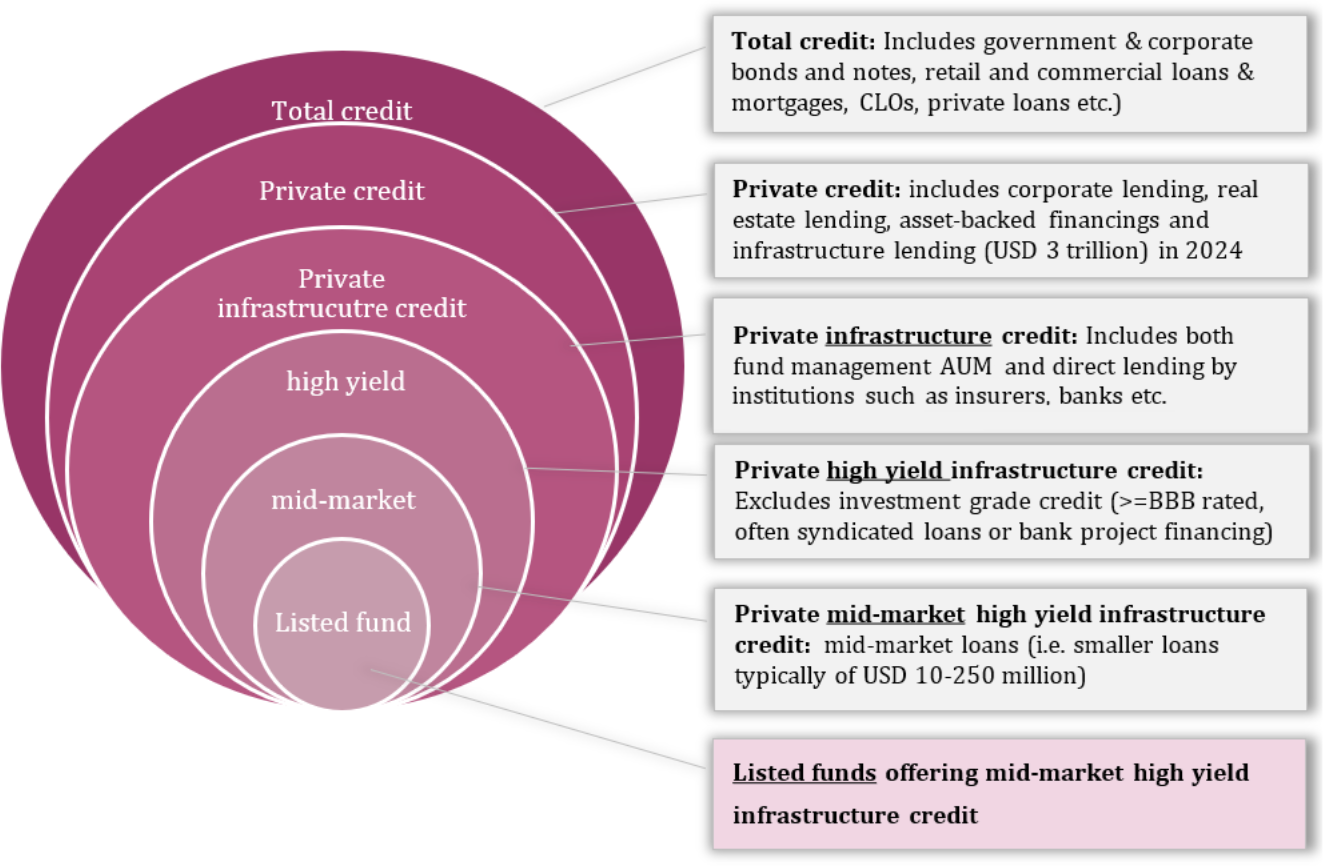

What is a Listed Private Credit Infrastructure Fund?

A private credit infrastructure fund (“Fund”) refers to an alternative asset fund, managed by an authorised Investment Manager with a mandate to invest the Fund’s capital into debt financing, focusing on non-bank lending to a diversified portfolio of private/unlisted infrastructure projects or borrowers (the instruments of which are typically NOT traded on an open or public market).

A listed private credit infrastructure fund is a publicly traded company or fund (listed on a stock exchange) that raises capital from public market investors to provide debt financing specifically for unlisted infrastructure projects.

Key concepts:

- Listed (publicly traded): You can buy or sell shares of the Fund on a stock exchange (e.g. LSE, HKEX). This provides liquidity, which is a major advantage over traditional, unlisted private credit funds that lock up capital for years.

- Infrastructure: The Fund specialises in lending to infrastructure sector, providing loans to projects or companies that develop, own, or operate infrastructure assets.

Key benefits of infrastructure assets:

- Real asset class: Infrastructure represents a tangible asset, generally retaining a residual value.

- Essential services: The assets often provide critical services with predictable, inelastic demand (people need electricity, water, and roads regardless of the economy). This leads to relatively more stable and predictable cash flows.

- High barriers to entry: Infrastructure requires a high level of initial capital investments, and this could be an impediment to potential competitors entering the market.

- Long-term cash flow predictability: Regulation often provides long-term revenue visibility to infrastructure investments.

- Inflation hedge: The ability to pass on price inflation to end consumers varies depending on the type of infrastructure asset. Most regulatory frameworks permit regulated assets, such as those involved in electricity transmission and distribution, to implement inflation-indexed user tariffs.

Marketable fund tradable on open market:

Shares of a listed private infrastructure credit fund (with stock code) can be dealt with by all investors on a stock exchange, provided that certain requirements are satisfied.

The share price of a close-ended fund is determined by supply and demand in the market. Therefore, it almost always trades at either a “premium” or a “discount” to its Net Asset Value (NAV).

Illiquid investments projects:

Projects/Debt instruments invested/lent by private infrastructure credit funds are generally unlisted/illiquid, and themselves NOT traded in secondary markets. This is versus traditional bank loans (syndication), which otherwise might be more receptive to (inter-bank or inter-financial institution) secondary market for trade-sale.

Private debt investments are typically held to final repayment at maturity of the debt instrument.

Variety of debt instruments:

Private infrastructure credit can take the form of:

- senior secured loans,

- subordinated/mezzanine debt, and

- other structured debt instruments tailored to infrastructure projects financings, borrowers or loan portfolios.

Infrastructure sectors:

Infrastructure consists of basic facilities that underpin a society’s economy and daily life, including:

- Renewable energy: Solar, wind, gas plants

- Power/Utilities: Electricity transmission & distribution, water treatment & supply, waste management

- Digital infrastructure: Data centers, fiber optic networks, telecommunication towers (cell, towers), cables

- Transportation: Airports, toll roads, railways, bridges, ports, tunnels, etc.

- Healthcare

Institutional investors:

Private infrastructure credit is primarily provided by institutional investors, who seek stable, long-term yield/return from infrastructure credit, such as:

- pension funds,

- insurance companies, and

- sovereign wealth funds.

Diversification benefits:

Private infrastructure credit can provide diversification benefits to investor portfolios, as the yield/return tend to have low correlation with other asset classes like conventional equities and bonds.

Risk-Return Profile:

Private infrastructure credit generally offers a risk-return profile that sits between traditional public bond/note and private equity, with

- potential for higher yields compared to public bond/note, but

- lower risk compared to equity investments in infrastructure.

Specialised expertise:

Investing in private infrastructure credit requires specialised expertise in areas such as:

- project finance,

- credit analysis, and

- infrastructure asset management,

which is typically provided by dedicated infrastructure investment managers.

What are the Risks of Investing in a Listed Private Infrastructure Credit Fund?

Private infrastructure credit funds use alternative investment strategies, and the risks inherent in the Fund are not typically encountered in traditional funds. It undertakes special risks which may lead to substantial or total loss of investment and is not suitable for investors who cannot afford to take on such risks. The risks include, but not limited to, the following:

Closed-ended fund structure:

- Shareholders cannot demand redemption of listed shares.

- The Fund’s listed shares may trade at a discount to the Net Asset Value per share after listing, and this discount may persist.

- Shareholders can only sell the Fund’s listed shares in the secondary market (or to the Fund through its share buyback program (if any)).

- No assurance that Shareholders will be able to dispose of the Fund’s listed shares at any price or at all.

Non-guaranteed dividend:

- The Fund’s target dividend is NOT guaranteed and may be lower than expected.

- Dividends may be paid out of the Fund’s capital or effectively out of the Fund’s capital.

Currency risk:

- The Fund’s income will be subject to fluctuations in currency exchange rates.

- The Fund may hedge this risk but may NOT be able to hedge against this risk at an acceptable price or at all.

Lack of operating history and investment uncertainty:

- The Fund may have NO prior operating history, and investors will rely on the ability of the Investment Manager and Investment Adviser to identify and evaluate investments.

- This may expose the Fund to risks of changes in interest rates and adverse developments in infrastructure debt markets.

Valuation Uncertainty, Lack of Transparency, and Liquidity Risks:

- There is a lack of transparency on valuation of alternative assets, and significant uncertainties are involved in the valuation of alternative assets and that such valuation is heavily dependent on assumptions and valuation models, which may be inaccurate.

- Infrastructure debt investments (generally illiquid) may be difficult to value or sell, and the price achieved may be lower than the valuation.

- This can adversely affect (or lead to inaccuracies in calculating) the Net Asset Value and/or market price of the Fund’s listed shares.

Macro risks:

- The Fund will be exposed to macro risks such as geopolitical issues, epidemics, and trade barriers, which can adversely affect the Fund’s target geographies and returns.

Geographical market risks:

- The Fund may invest in markets, countries or jurisdictions which may be subject to, or may experience, increased risks and special considerations.

Regulatory and legislative changes:

- Changes in government regulations and policies can increase the Fund’s expenses, lower its income or rate of return, or adversely affect the value of its investments.

Sustainability risks:

- Climate-related events, social events, and governance shortcomings can translate into sustainability risks that may affect projects’/borrowers’ cash flows and default likelihood.

Project/Borrower default and insolvency risks:

- Projects/Borrowers may default on their obligations to the Fund, adversely affecting the Fund’s income and the value of its assets.

Lack of diversification:

- If the Fund invests exclusively in infrastructure debt, then it may be exposed to the risk of lack of sector diversification (i.e., to non-infrastructure-related sectors).

Interest rate risks:

- Changes in interest rates can adversely affect the value or profitability of the Fund’s assets.

Subordinated debt risks:

- Investing in subordinated debt can lead to disproportionately large losses for the Fund in the event of a project’s/borrower’s default.

Regulatory risks for regulated utilities:

- Investments in regulated utilities are subject to risks arising from the regulatory framework, which can impair a utility’s ability to service its debt.

Construction and cash flow risks:

- The Fund may lend to companies that are not yet cash generative or are exposed to construction risks, which can adversely affect their ability to service debt.

Energy market risks:

- Changes in government policy, technological advancements, and merchant risk can impact the profitability of renewable energy or other power projects and the Fund’s investments.

Developing a liquid trading market:

- The Fund’s listed Shares will not have been publicly traded before the initial public offering.

- Listing the Fund’s Shares on the Stock Exchange does NOT guarantee the development of an active and liquid trading market.

- If there is no active market, Shareholders may receive a lower price when selling the Fund’s listed Shares than their fair value.

Share price fluctuations:

- The Fund’s listed share price can fluctuate and may trade at prices higher or lower than its Net Asset Value per share.

- Failure to meet market expectations on future earnings and cash distributions can adversely affect the Fund’s listed share price.

- Shareholders may NOT get back their full investment amount and could potentially lose all or part of their investment if the Fund is liquidated.

Dilution of Net Asset Value:

- Further issuance of shares or sale of treasury shares at a price below the existing Net Asset Value per share will result in dilution.

- This can reduce the Net Asset Value per share for existing Shareholders.

Transaction costs:

- Investors will incur charges, such as trading fees and brokerage fees, when buying or selling the Fund’s listed shares on the Stock Exchange.

- These charges may result in investors paying more than the market-quoted trading price when buying, and receiving less than the market-quoted trading price when selling.